What you need to know about real estate purchase agreement in Ukraine

Buying an apartment or a house in Ukraine is impossible without drawing up a real estate purchase agreement . This is an official document indicating the transfer of ownership from one party to another. The contract is filled out at the notary during the execution of the transaction. What is important to know about the real estate purchase agreement, read below.

What is a real estate purchase agreement

A real estate purchase agreement is a document according to which the seller undertakes to transfer ownership of the property to the buyer. In this case, the buyer undertakes to accept the property and pay the specified cost for it.

Regardless of what type of real estate you decide to buy - a house, an apartment, a land plot, you will need to draw up a real estate purchase agreement . A document created in writing is certified by a private or public notary.

What does a real estate purchase agreement contain

Any contract, including the real estate purchase agreement, includes several main parts.

What does a real estate sale and purchase agreement contain:

Contract cap. Here you can see the personal data of the owner of the property and the buyer, the date of the document. Full name and passport data must be recorded without errors, otherwise this may lead to the recognition of the contract as invalid.

Subject of the contract. This part lists the documents required for the transfer of property into ownership, the characteristics of the living space, including the address, type of property and other details.

The value of the property. The price of an apartment or house is prescribed in the preliminary contract, after which the seller can no longer raise or lower it. The cost is indicated in hryvnia (national currency of Ukraine) . There may also be information on how to pay.

Payment procedure. If this part of the contract is not included in the previous one, then it must be clearly spelled out separately. The buyer can make full payment on the spot or agree with the seller on a payment plan. Regardless of the agreements between the parties, they should be indicated in this part of the document.

Rights and obligations of the parties. Both standard formulations and individual moments for a particular transaction are prescribed here. For example, if property is being sold with an installment plan, it is important to indicate this in the document in the form of additional rights and obligations of the seller and buyer.

Other conditions. This part includes everything that is not specified in the previous paragraphs of the contract. Here you can specify the date of the seller's eviction from the house, the party that pays taxes, and other "minor" conditions.

Before signing a real estate purchase agreement, it is important to carefully study it in order to avoid unpleasant surprises later.

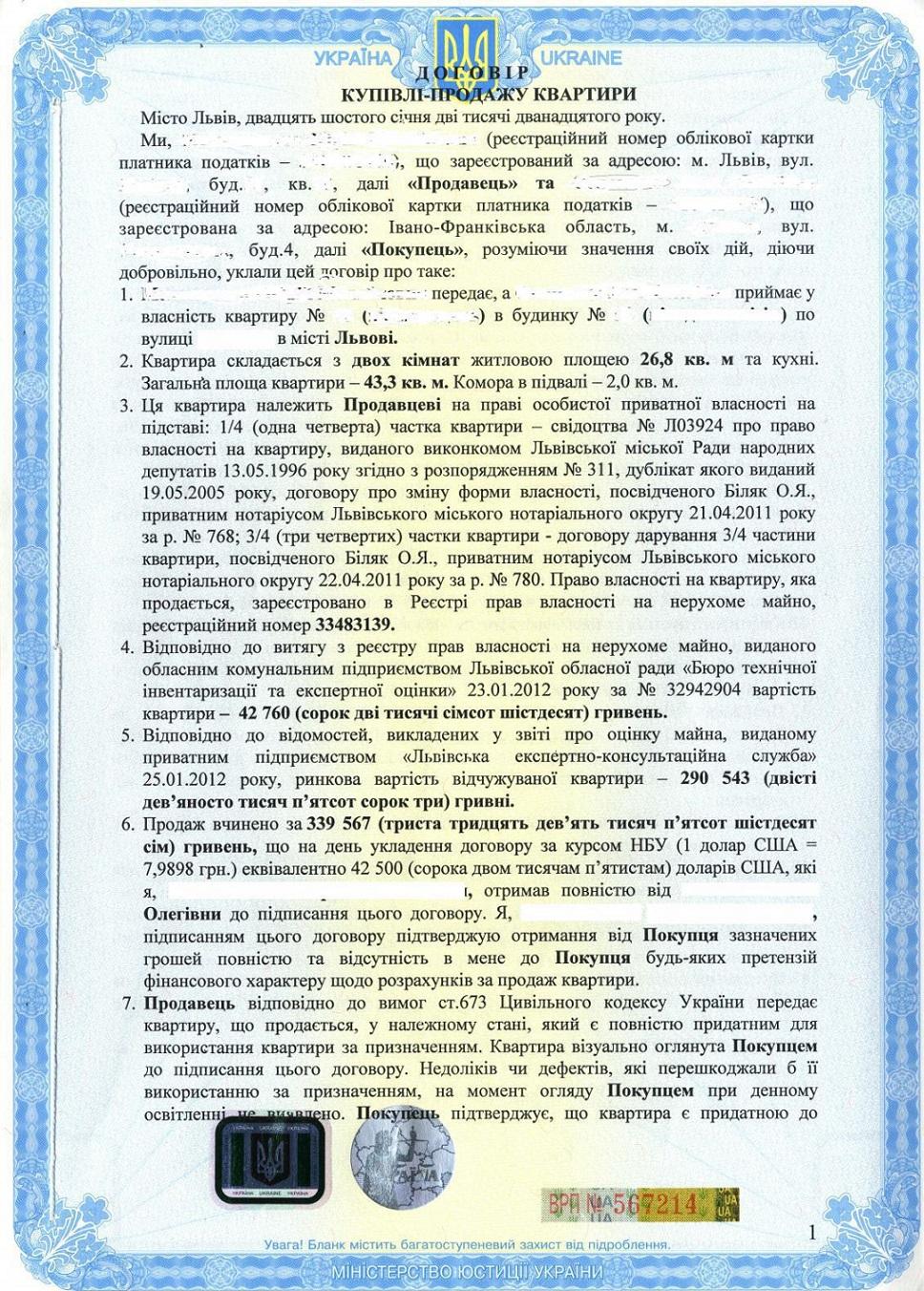

What does a typical sample sales contract look like in Ukraine

A typical contract for the sale of an apartment contains all the points indicated in the previous section. For a real estate purchase transaction in Ukraine, it is quite possible to use a standard sample. Here you can see what it looks like. But remember that you can’t do it without notarization of the document.

What is a pre-purchase agreement

A real estate purchase transaction consists of four main stages. The first stage is the execution of a deposit agreement or a preliminary agreement. What is this document?

The preliminary, as well as the main contract, must be concluded in writing and certified by a notary. This is how you can formalize oral agreements between the buyer and the seller, which relate to the cost of living space, the procedure for payment, etc.

The difference of pre-purchase agreement is that under it the buyer does not receive ownership of the property. This document is intended to provide legal force to the transferred cash deposit.

The document contains the following information:

the subject of the transaction;

full obligations of the parties;

term of conclusion of the main contract;

deposit amount.

When drawing up the contract, it can be foreseen that the deposit is returned to the buyer in the event of a change in the terms of the transaction.

What real estate can and cannot be concluded a real estate purchase agreement

The acquisition of an apartment will be considered legal if the contract of sale is correctly executed, and the living space itself belonged to the seller legally. The owner must provide a document that confirms the right of ownership, and be registered in the electronic register.

So, if the apartment or house is legally owned by the seller, the buyer can make a deal and sign a contract of sale. It is important to note that if the property was purchased during marriage, the other spouse must provide their consent to the transaction. If the apartment has other owners, they must all provide a written consent to the sale of the apartment.

It is also important to check if there is an disabled person or a underage among the homeowners, you will have to obtain permission from the guardianship authorities. When one of the owners cannot be present at the conclusion of the transaction, you will need a power of attorney on his behalf for the right to sell real estate.

There are several types of real estate that cannot be sold and, accordingly, it is impossible to conclude a real estate purchase agreement for it:

non-privatized housing;

departmental;

social;

official;

property on which the arrest / ban is imposed;

housing for which the mortgage is not paid.

In order for the sale and purchase transaction to be successful, it is important to make sure that the property does not belong to the above list and that the property owners have all the necessary documents.

How to draw up a real estate purchase agreement: important information

When drawing up a real estate purchase agreement , it is important to consider what type of housing is being sold / bought. This depends on the type of contract that needs to be completed.

Flat

If we are talking about the sale / purchase of a flat, you can use a sample of a standard real estate purchase agreement. In transactions where the consent of guardianship, notarized consent of the spouse or a power of attorney from the absent owner is needed, it is important to take care of the presence of these documents.

House

If we are talking about selling / buying a house, this transaction is a little different. The owner transfers to the buyer property rights not only to the property, but also to the land. Since, according to Ukrainian laws, a house and land must have one owner. In this regard, the land on which the house is located must be indicated in the contract of sale.

When concluding a deal for the sale of a house, you will need standard documents, as when selling or buying a flat. But there are also additional papers. These include documents on privatization, the State Act on the land, the cadastral number of the land plot assigned during state registration.

Property in a new building

When buying real estate in the primary market, it is allowed for the parties to conclude a consensual sale and purchase agreement. Its main feature is that the seller transfers the object to the buyer not at the time of signing the contract, but later. Most often this happens after the building is put into operation by the developer or at other agreed times. When the property will be handed over to the buyer and when he will make the payment, it should be clearly stated in the contract.

When planning to buy an apartment in a new building (off plan), you can use one of the following agreements:

purchase and sale of property rights;

investment agreement;

purchase with the help of the CFF (Construction Financing Fund);

equity participation in construction (DDU);

purchase and sale of bonds;

payment of share contributions through a community;

purchase and sale of a derivative;

joint venture agreement.

Additional important moments on how to properly draw up a purchase agreement of an apartment or house:

indicate the fair amount of the transaction. It is not recommended to reduce the value of real estate in order to save on taxes. In case of problems with the sold or purchased apartment, it will be possible to reimburse only the amount indicated in the contract, even if it does not match the real one;

check original documents. It is impossible to conclude a sales contract if the seller has provided a copy of the technical passport or any other document from the list of mandatory. Before signing the contract, you need to see the originals, and they must be available at the time of the transaction;

attach the power of attorney to the contract. If the housing is sold or bought by proxy, you need to attach it to the general package of documents.

How much does it cost to execution of a real estate purchase agreement

All taxes, payments and costs associated with the purchase and sale of real estate, the seller and the buyer discuss before the preliminary agreement. This makes it possible to calculate additional expenses and, if necessary, add them to the price of the apartment or house. This approach avoids disputes and disagreements during the transaction: everyone knows what they are paying for and how much they are paying.

Since the law does not regulate the question of who exactly pays the state duty and the contribution to the Pension Fund, the parties agree on this individually. More often than not, the seller bears the costs of paying the state duty, while the buyer pays the contribution to the Pension Fund and the services of a notary. But it can also happen that the costs are divided strictly equally, or all costs are covered only by the buyer.

If a standard contract is drawn up, the costs will be as follows:

personal income tax (personal income tax) - 5%;

state duty - 1%;

military fee - 5%;

contribution to the Pension Fund - 1%.

Personal income tax may also be 0%, but only if the seller is a first-time buyer in the reporting year, has owned the property for more than 3 years or received it as an inheritance.

The fee to the Pension Fund may not pay buyers who purchase their first real estate. It happens that the notary during the conclusion of the transaction may require confirmation of payment of the contribution to the Pension Fund. Then it is possible to issue a refund in the relevant body.

These are not all the costs associated with the purchase and sale of immovable property. In Ukraine, payments exceeding the amount of UAH 50 thousand must be made by bank transfer. To open an account, transfer and further cashing of the money, you will have to spend about 2000 UAH depending on the amount.

Also the buyer or seller needs to pay for the services of a notary. Prices for notarization are different, for example, for Kiev the cost of such services is from 10,000 UAH.

Until recently, sellers of real estate had to pay about 3000 UAH for determining the appraised value of residential property. Since 2021 the service of automatic assessment of real estate objects has been working, which significantly simplified and reduced the cost of the procedure. With the help of the new resource, the owner can free of charge generate an electronic certificate of the appraised value of an apartment or house, which is needed to formalize a sale and purchase transaction. If the seller is not satisfied with the result of the automatic determination of the appraised value, then it is possible to turn directly to an appraiser: the cost of the services of a specialist is negotiable.

A properly drafted, notarized and registered real estate sale and purchase agreement shows that the title to the housing has been transferred to the buyer and he is the new legal owner of the purchased apartment or house.